Hello HR heroes, legal leaders, and hiring maestros!

In this February 2024 newsletter, I share updates about:

- Overhaul of the H-1B registration and lottery process

- Updates about Employers New Organizational Accounts to participate in the H-1B cap lottery

- H-1B and other USCIS Filing Fees To Increase starting April 1st 2024 and Premium Processing Fee Increase becomes effective February 26, 2024

_____________________________________________________________

Overhaul of the H-1B registration and lottery process

Here are the highlights

Under the new process, the selection will beneficiary-centric which means:

- Unique Beneficiary Selection: Each beneficiary’s chance of being selected is independent of the number of registrations submitted on their behalf.

- Mandatory Valid Passport or Travel Document for each Registrant/Candidate

- One Registration per Passport: Each beneficiary can only be registered under one passport or travel document.

FY25 H-1B Cap Registration will open at 12:00 PM EST on March 6, 2024, and run through 12:00 PM EST on March 22, 2024. Employers or their legal representatives can register H-1B cap candidates only during this period

Registration will take place through the “upgraded” myUSCIS online account for employers.

- It is expected that USCIS will receive enough registrations to meet the H-1B cap numbers and conduct a lottery selection.

- Employers should finalize their H-1B cap candidates list by mid-February and work with their immigration attorney and candidate to ensure they are ready for registration.

- On-line filing of Form I-129 and I-907 will be available for the first time ever for these filings. However, because this process is untested and will require significant manual data entry, as many other distinguished attorneys, we are considering filing hard-copies of the filings which remains USCIS’ predominant case filing method.

Updates about Employers New Organizational Accounts to participate in the H-1B cap lottery

USCIS will be using new organizational accounts for this year’s H-1B cap season. The details of how these accounts will work is not fully known yet and we’re learning a little more every day.

Here are the highlights for Employers

- If an Employer has a myUSCIS account from previous seasons, you will not need to create a new account. When you log in for the first time, follow the on-screen instructions to upgrade the account.

After upgrading the account, you will be able to send invitations with instructions to others to join their group.

- If you do not have a myUSCIS account from previous years, you or your legal representative will be able to create one starting February 28th. We strongly recommend that you work with your immigration counsel for this process and do not attempt to do it on your own. According to USCIS, there is little flexibility on fixing errors on these accounts.

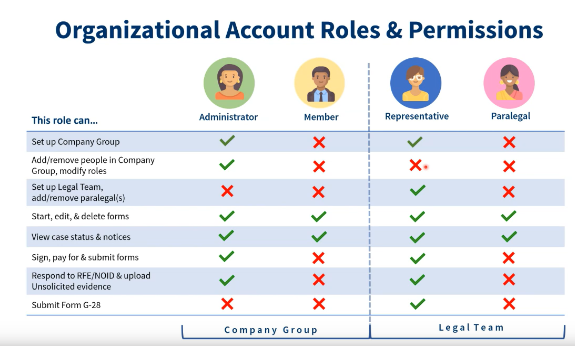

- You must designate an ADMINISTRATOR (company representative) who will have a wide range of account management capabilities as shown below

- Legal Representatives / Attorneys will be able to help employers create their accounts and also have a wide range of capabilities as shown below

We are optimistically cautious about this process and the possibilities.

Related Links: 👇

USCIS Organizational Accounts for H-1B cap FAQ

H-1B and other USCIS Filing Fees To Increase starting April 1st 2024 and Premium Processing Fee Increase becomes effective February 26, 2024

- I-129 H-1B > from $460 to $1,080

- I-129 H-1B for small employers and nonprofits > from $460 to $540

- I-129 L Nonimmigrant Workers > from $460 to $1,385

- I-129 L Nonimmigrant Workers for small employers and nonprofits > from $460 to $695

Note about these fee increases

- Form I-129 filing fee will increase differently across various nonimmigrant classifications

- H-1B — $780 (70% increase)

- L-1 — $1,385 (201% increase).

- E and TN — $1,015 (121% increase)

- Additionally, USCIS is imposing an added “tax”of $600 as Asylum Program Fee on employers who need work visas for skilled workers.

- The fee change is $0 for nonprofits; $300 for small employers (defined as firms or individuals having 25 or fewer full-time employees); and $600 for all other filers of Forms I-129 and I-140.

Related Links:

USCIS final rule, 89 Fed. Reg. 6194 (Jan. 31, 2024)

USCIS FAQ on fee rule (Jan. 31, 2024).

________________________________________________________

Upcoming Events

H-1B CAP – What you need to know for Employers Webinar

Tues, Feb. 20th from 2 to 2:30 pm for Employers

Register here: https://us02web.zoom.us/meeting/register/tZcud-Gppz8uEtX-Go_N9IvjGt6hnL9kvOq5

H-1B CAP What you need to know for Employees Webinar

Thurs, Feb. 22nd from 2 to 2:30 for Employees

Register here: https://us02web.zoom.us/meeting/register/tZcud-Gppz8uEtX-Go_N9IvjGt6hnL9kvOq5

These webinars will provide you with the essential knowledge that you need to embark in the H-1B cap season with confidence.

Topics will include:

- Overview of H-1B visa cap

- Timeline, Registration & Notification of Selection

- Org Accounts, New Fees, On-Line filing

- Cap Gap & Work Authorization

- Travel

Note – Employers and Employees can participate in either one or both of these webinars.

However, I will cover content more specific to employers in the employers’ webinar and vise versa.

Did you find this Corporate Immigration Update valuable?

Don’t forget to FORWARD to others who can benefit. Subscribe so you never miss an update again!