There is a common misconception that estate planning must be a complicated, costly, and time-consuming process.

Many people avoid the estate planning process until they encounter a serious health problem, a time when they should be focused on healing or spending time with family. Still others never get around to it at all, leaving it up to loved ones and the court system to determine their final wishes.

But the truth is that everyone can benefit from estate planning – and with the right legal help, it can be completed in an efficient and cost-effective manner.

What Exactly Is Estate Planning?

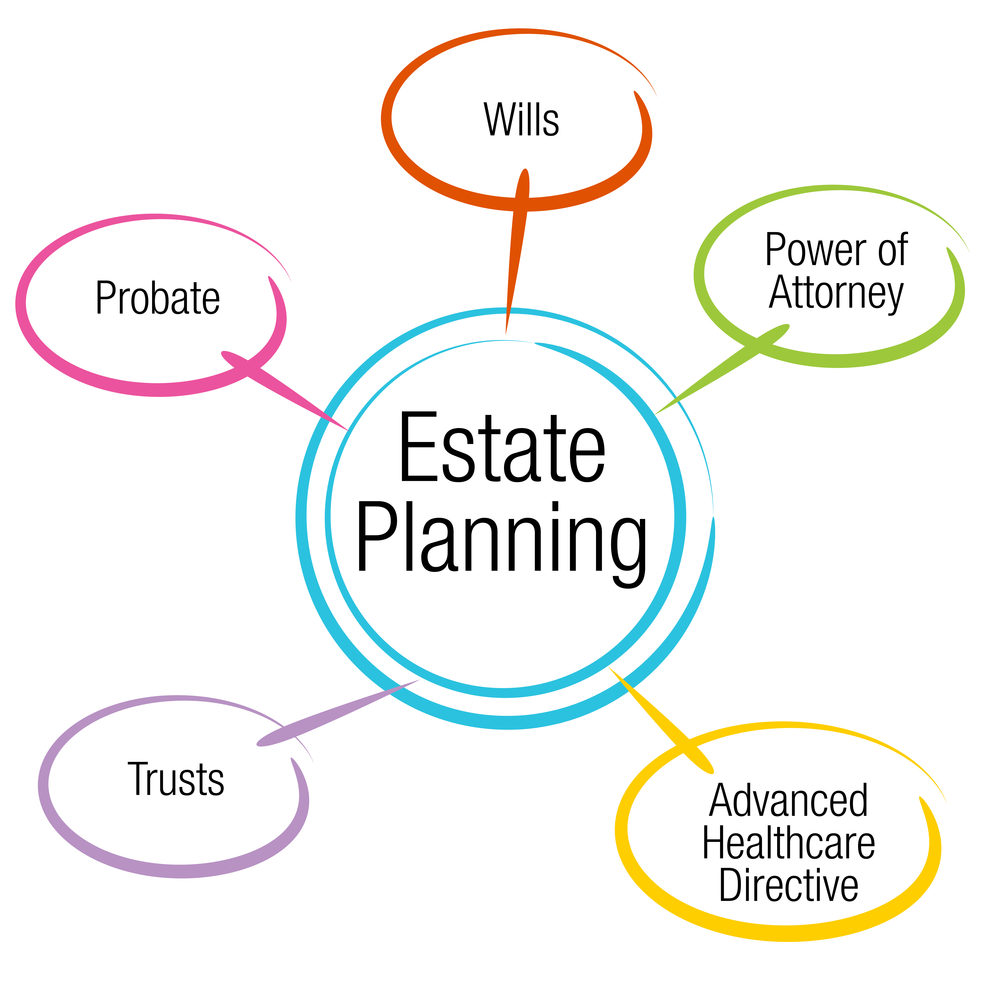

First, let’s cover what estate planning means. Quite simply, it is the process of creating any and all documents necessary to manage your property in the event of your incapacity, and ultimately govern the disposition of your property to your beneficiaries upon your death.

An estate plan may be as basic as a simple will and powers of attorney, or it can consist of more complex planning using trusts or similar documents.

Step 1: Schedule a Free Planning Conference

There is no cost for your initial estate planning conference. At that meeting, we will review and discuss your entire financial situation, as well as your wishes regarding disposition and management of your assets when you die or if you become disabled.

Before you leave, we will present you with a plan that has been customized for your needs and tell you exactly how much it will cost. While we hope we earn your trust and approval to proceed, you are under no obligation.

Step 2: Consider These Key Questions

Before your appointment, take some time to answer these questions.

- Who do you trust to make medical and/or financial decisions should you become incapacitated?

- Who will act as personal representative (executor) and/or trustee upon your death?

- Who will act as guardian of any minor children?

- Do you want to give any specific gifts of personal property and/or cash to specific individuals or charities?

- How will the balance of your estate be divided?

Step 3: Gather Key Information

Here’s what you should bring to your estate planning conference.

- Copies of current estate planning documents, if any (e.g., last will and testament, trust documents, durable power of attorney)

- Copy of your prenuptial agreement, if any

- Names and contact information of:

- Spouse

- Children

- Beneficiaries – if different from above

- Alternate Personal Representative(s)/Trustee(s) – if different from above

- Summary of your current assets and their values

- Copies of deeds to any real estate

- Information on any beneficiary with special needs

To assist you, you can download our Confidential Estate Planning Information Worksheet.

Then just show up to your appointment, and we’ll be there to guide you through the rest of the process.

We understand that sometimes the decisions that go into creating your estate plan may feel overwhelming or intimidating. This is totally natural. Rest assured that, from the moment you contact us, we will make the process as smooth and worry-free as possible.